Keep your personal data safe with Avast Mobile Security for Android.

- Security

- Privacy

- Performance

Identity thieves are on the prowl. Their cause is unrelenting, so your defenses should be too. Avast BreachGuard continuously monitors for data breaches and rings the alarm the moment your personal data has leaked. Learn more about different types of identity theft, which hacks are on the rise, and how robust privacy software can help protect you against a stolen identity.

If you already know (or think) that your personal information has leaked, jump down immediately to our sections on protecting yourself from identity theft, how to check if your identity has been stolen, and how to report identity theft.

There are several small steps you can take to prevent identity theft from happening to you and your loved ones. Educate yourself and create an action plan for protecting your personal data and keeping it off the dark web and other unsecured marketplaces.

This Article Contains:

Identity theft is when someone steals your personal information in order to pose as you and reap financial benefits. The stolen identity may include your full name, birthdate, address, social security number, tax ID, bank details, passwords, and pin codes.

But a hacker doesn’t need to have all those different pieces of information to commit identity fraud. Cybercriminals have lots of ways to make you a victim of identity theft. Knowing how to protect yourself and prevent cybercrime is essential.

Even though the consequences of a stolen identity can be catastrophic — both financially and emotionally — most people don't take personal action to prevent identity theft. In fact, 81% of Americans say they rely on their bank to protect them from fraud.

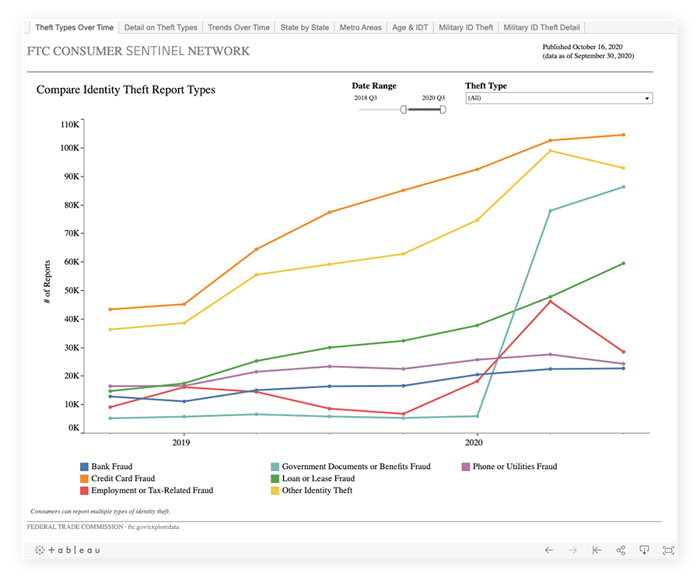

The most common types of ID theft include Credit Card Fraud, Loan or Lease Fraud, Employment or Tax-Related Fraud, Phone or Utilities Fraud, Bank Fraud, and Government Documents or Benefits Fraud, which has increased sharply in 2020 (likely related to COVID-19 compensation claims — see the light-green trendline in the graph below).

If you suspect your personal information has leaked, there are several ways to check for identity theft. Along with monitoring suspicious transactions on your accounts, there are some free identity theft check tools to tell you if your information has been exposed.

Here are some common signs that may indicate you’ve been targeted for identity theft:

Unauthorized bank transactions you don't remember making

Suspicious login notifications from your accounts (email, social media, banks)

Bills received for items you didn’t buy

Calls from debt collectors for accounts you didn't open

Missing bills or other missing mail you normally receive

Medical bills received for services you didn’t get

Loan applications denied

A notification of double tax filing from the IRS

Health benefits rejected due to reaching the limit

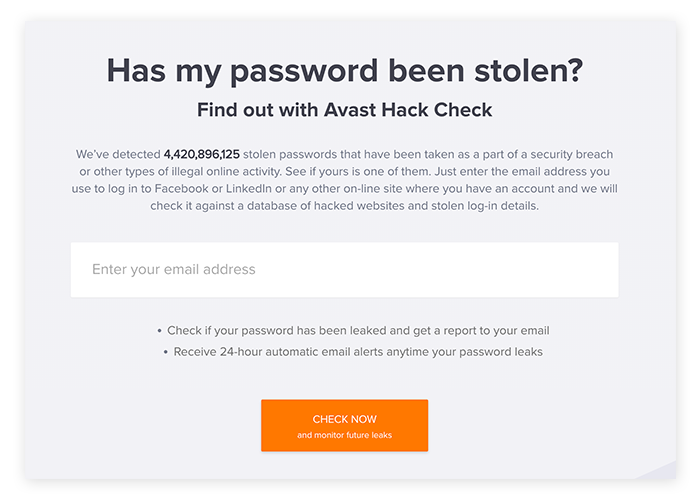

Avast Hack Check is a free tool that quickly scans your email address to see if it’s been included in a data breach. It's a first step in getting your identity theft prevention plan underway and knowing if your information has been exposed to hackers.

Effectively knowing how to prevent identity theft and keep yourself protected from a stolen identity is a matter of consistent vigilance and following a few simple tips. Fraud can happen to anyone, but it's more likely to affect those who are careless with their personal data. Each of the following identity theft prevention tips will help protect yourself against ID theft and keep cyberminals away from your sensitive info.

Never use your birthdate, phone number, or physical address for your passwords and pin codes. This information is too easy to be targeted for identity theft. If your friend or relative can guess your pins, a hacker can, too. Try a random password generator, or get crafty with creating a strong password (with a mix of letters, numbers, and symbols). Then, find a good password manager to keep track of all your passwords.

Oversharing on social media (and other public forums) is easy. It's the place we go to celebrate life events and connect with those we love (and people with similar interests). Social media accounts are also a goldmine for cybercriminals who know what to look for, as well as other shady characters seeking to exploit personal lives through doxxing or other acts of bullying. For starters, update your Facebook privacy settings and limit who can see your posts on Instagram.

Check your bank statements regularly for unrecognized transactions. If something fishy appears, that means you've already been targeted and your credentials have been stolen. The sooner you spot the fraudulent transactions, the higher the likelihood of minimizing any losses. An unusual bank transaction includes anything you don't recognize, any duplicate transactions, as well as any overseas charges that happened when you weren’t abroad.

Cover the keypad when you enter your PIN into an ATM machine or point-of-sale portal. And limit exposure of your sensitive data by not carrying all your cards at once.

Understand the dangers of phishing schemes and other internet scams by knowing what hackers are looking for. When you understand the game they play, you're better prepared and better protected.

Shred physical items with sensitive data and encrypt digital documents. And delete your browser cookies periodically, because there's no need to leave a trail of data for prying eyes and potential identity thieves.

If you're at risk of someone fraudulently taking a loan or line of credit out in your name, you can freeze or lock your credit. Both tactics block lenders from viewing your credit report from the three US credit reporting bureaus — Equifax, TransUnion, and Experian. If a lender can't view your credit history, they’re likely to deny any type of loan attempted in your name.

Unfreezing your credit requires a PIN and contacting each of the credit bureaus mentioned above, but unlocking credit is as easy as a real-time click on your phone.

Using public Wi-Fi may be free, but it comes at a cost. Your identity is at risk every time you access an unsecured network without a security tool like Avast SecureLine VPN.

By using a secure internet connection, public Wi-Fi is no longer a risk. Browse freely and confidently on any network knowing that Avast SecureLine VPN is encrypting your information and communications.

Even if you follow all the prevention steps mentioned in the previous section, it's still possible for your personal data to leak online and even wind up in the hands of data brokers. Data breaches happen every day, and the best you can do once that occurs is to stay informed with 24/7 data breach protection.

How to check for identity theft? Let Avast BreachGuard do the identity theft check for you. Avast BreachGuard works around the clock, scanning the web to see if and when your identity was stolen. It also supports identity theft prevention, by helping to remove your personal data from vulnerable places, such as data broker lists.

You can also get a free identity theft check credit report through one of the three major credit bureaus listed above. A credit report provides an overview of your credit history, and includes information that lenders have on you, like where you live, how you pay your bills, and if you've ever been sued or filed bankruptcy.

Because these US credit reporting companies — Equifax, TransUnion, and Experian — sell your information to creditors, insurers, employers, landlords, and lenders, the Fair Credit Reporting Act (FCRA) makes it your right to know what's being sold. You can request your free credit report every year. And US federal law requires easy access to this report, which can be requested here (link opens only in the US).

Once you know your personal data has been exposed or compromised, you need to know how to report identity theft. Take immediate action by changing all your account passwords and cancelling or blocking your credit and bank card. These key security steps are your first defense against identity fraud.

Like other crimes, it's important to report identity theft. Don't fight it alone. In the US, the Federal Trade Commission (FTC) and your local police department have processes to deal with identify fraud. In the UK, Action Fraud, the national cybercrime reporting center, will help you. This handy guide to reporting internet fraud and online scams can help get you started. In the meantime, follow the steps below.

Make a list of all your bank accounts, bank cards, and credit cards (even store-specific credit or loyalty cards).

Find contact details and phone numbers for each card and account.

Call them based on priority or vulnerability, most likely starting with your bank.

Contact one of the three credit reporting bureaus (Equifax, TransUnion, and Experian) and request that they put a fraud alert on your account.

Once you contact one bureau, they’re required by law to inform the other two. This free fraud alert lasts for one year and acts as a red flag on your credit report to warn lenders that you may be a victim of identity fraud.

For fraud committed in the USA, contact the FTC.

For fraud committed in the UK, contact Action Fraud.

For fraud committed in other countries, search out the relevant authorities online.

Look up the contact information for your local police department and follow their steps for reporting identity theft. Having the theft on file with as many relevant agencies as possible can help for future prevention and the recovery of losses.

Track everything you do in your fight against identity theft.

Keep a record of everyone you’ve contacted about the fraud and any steps they’ve taken on your behalf.

Mark important follow up dates in your calendar to stay on track.

Nobody wants to deal with the financial and emotional fallout of identity theft. That's why prevention is the best tool. Protecting yourself online and keeping a close eye on your credit score are the best approaches to safeguarding your identity.

When you browse the web, it seems like data requests happen instantaneously. In reality, the route your personal data takes is long and unsecured. Along the route — from your personal device, to a private or public router, to an Internet Service Provider's (ISP) server, and finally to your internet destination — your browsing habits, passwords, and login details can be exposed and compromised.

Hypertext Transfer Protocol Secure (HTTPS) websites are safer than HTTP websites, because data sent to an HTTPS webpage is encrypted to ensure secure data transfer. You should never enter sensitive information into an unsafe website that doesn’t use HTTPS.

For ultimate security, use a VPN (Virtual Private Network). A VPN like Avast SecureLine VPN is the only surefire way to protect your data and keep it private. Even your ISP won't be able to track your browsing habits. So, if they get hacked, you won't get hacked.

A tumbling credit score is an indication of suspicious activity. Monitor your credit score by getting a free credit score report from a local credit-reporting agency. ClearScore is a popular free service for residents of the UK, Australia, India, and South Africa. US residents can use Experian, which will show you your FICO score for free — the number often used by lenders to assess your credit-worthiness.

Defend your privacy and be the first to know when a data breach occurs. Early identity theft detection lets you take control of your accounts and data before they’re exposed to hackers.

Avast BreachGuard helps prevent identity theft on multiple fronts — first, we monitor the web 24/7, checking for hacks and data breaches. Second, we help remove your data from vulnerable websites or databases that are likely targets for hackers. And finally, we advise you on how best to safeguard your personal information and lock down the privacy settings of your personal accounts. Don't let your identity get bought, sold, or stolen by identity thieves.

Install free Avast Mobile Security for Android to keep your personal data safe and protect yourself against hackers.

Install free Avast Mobile Security for iOS to keep your personal data safe and protect yourself against hackers.

Get Avast BreachGuard for PC to prevent identity fraud and keep your personal data from falling into the wrong hands.

Get it for Mac

Get Avast BreachGuard for Mac to prevent identity fraud and keep your personal data from falling into the wrong hands.

Get it for PC

Keep your personal data safe with Avast Mobile Security for Android.

Keep your personal data safe with Avast Mobile Security for iPhone or iPad.